Balancing the Books: How To Outsource Accounting in 2024

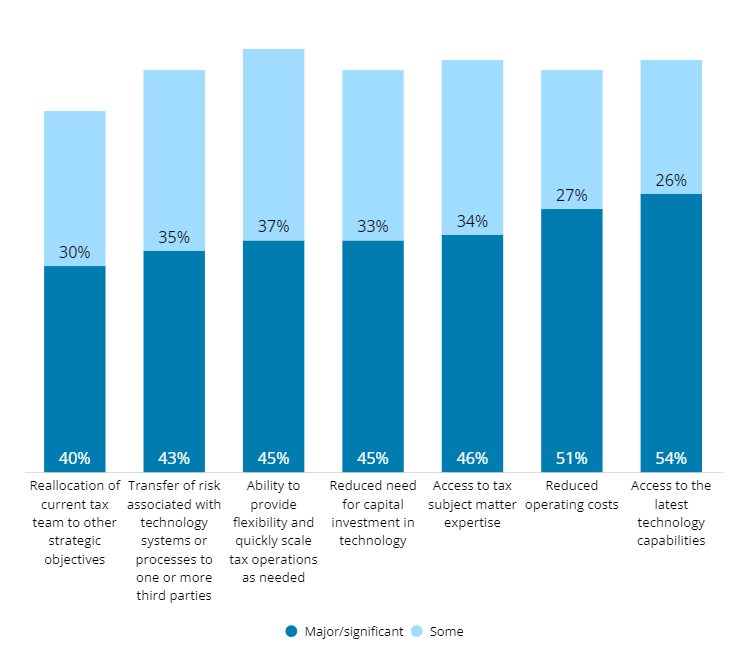

51% of businesses outsourcing an entire tax activity or function have seen a significant reduction in operating costs while 54% report having access to advanced technology — these are just some of the benefits of outsourced accounting.

Before looking into how to outsource accounting, many small businesses find themselves asking, “Should I outsource my accounting at all?” and if so, why?Well, the short answer is that timely and accurate financial insights empower businesses to make informed decisions, navigate complexities, and stay ahead of the competition. However, managing intricate accounting tasks in-house can be overwhelming. This is where accounting outsourcing companies emerge as a strategic solution, offering cost savings, specialised expertise, and scalability. According to a Deloitte study, 51% of businesses outsourcing an entire tax activity or function have seen a significant reduction in operating costs, while 54% report having access to advanced technology - these are just some of the benefits of outsourced accounting.By entrusting accounting functions to seasoned professionals, businesses can streamline operations, ensure compliance, and refocus internal resources on core competencies. But how do you go about finding the right outsourcing accounting and bookkeeping partner?

How To Outsource Accounting In 2024

1. Choosing the Right Accounting Tasks to Outsource

Selecting the right accounting tasks to outsource is pivotal for optimising organisational efficiency, especially for small to medium businesses. Tasks like routine bookkeeping, payroll processing, tax preparation, and financial analysis and reporting are prime candidates for outsourcing. Routine bookkeeping, involving day-to-day transactions and data entry, can be seamlessly managed by external experts, allowing your in-house team to focus on strategic initiatives. Payroll processing, a critical yet time-consuming function, benefits from outsourcing, ensuring accuracy and compliance with evolving regulations. Tax preparation and filing, often intricate and subject to constant changes, are best handled by professionals well-versed in tax codes. Financial analysis and reporting, crucial for informed decision-making, can be outsourced to specialists who bring a nuanced understanding of industry benchmarks. Additionally, it's imperative to assess the unique needs of your business before consulting accounting outsourcing companies. Considering factors like company size, industry specifics, and compliance requirements is key.2. Selecting the Right Accounting Service Provider

Choosing the right outsourcing accounting and bookkeeping company is a critical decision that can significantly impact the financial health of your business. Start by evaluating the reputation and experience of potential providers, paying particular attention to those with a proven track record in delivering reliable and accurate services.Assess the service provider's technology infrastructure to ensure it aligns with modern standards and can seamlessly integrate with your existing systems.

Understand the scalability and flexibility offered by the outsourcing partner, ensuring they can adapt to the evolving needs of your business.

Examining client testimonials and case studies provides valuable insights into the provider's performance and client satisfaction.

Consider the pricing models and transparency in costs. A trustworthy provider will offer clear and transparent pricing, helping you avoid hidden fees and unexpected expenses.

3. Managing Your Outsourced Accounting Projects

When managing outsourced accounting projects or tasks, several key considerations can ensure a smooth and successful partnership. Firstly, clear communication is extremely important. Establishing open channels of communication from the outset helps align expectations, address any concerns promptly, and encourage collaboration between your team and the outsourcing provider. Secondly, maintain transparency throughout the process. Be upfront about your business requirements, goals, and timelines to ensure that both parties are on the same page. Additionally, provide access to relevant information and resources to facilitate the outsourcing team's understanding of your business processes and objectives.You’ll also want to implement a proactive management style. Stay engaged with the outsourcing team, regularly reviewing progress and addressing any issues or roadblocks promptly. This approach helps prevent misunderstandings and ensures the project stays on track. Furthermore, embrace flexibility as outsourcing arrangements may require adjustments over time as business needs evolve. Be open to adapting the scope or approach, as necessary, to optimize outcomes and accommodate changing circumstances.You’ll also want to prioritise data security and compliance. Ensure that the outsourcing provider adheres to stringent security protocols and compliance standards to safeguard sensitive financial information. Regularly assess and review the provider's data security measures to mitigate any potential risks effectively.Lastly, cultivate a culture of accountability and feedback. Establish clear performance metrics and expectations, regularly evaluating the outsourcing team's performance against these benchmarks. Provide constructive feedback and recognise successes to incentivise continued excellence and drive results. By keeping these considerations in mind when determining how to outsource accounting tasks, you can shortlist the most suitable accounting outsourcing companies with ease. From there, you'll be able to confidently select an outsourcing service provider that not only meets your immediate needs but also contributes to your business's long-term financial success and growth.Overcoming Challenges in Outsourcing Accounting

Outsourcing accounting functions can be transformative for businesses, but it comes with its share of challenges.Communication barriers, data security concerns, and compliance issues are common hurdles that organisations may face. Effective strategies are essential to overcome these challenges successfully.

Establishing clear and efficient communication channels is vital to bridge gaps and ensure seamless collaboration between the business and the outsourcing partner.

Robust data security measures, including encryption and access controls, must be implemented to address concerns about the confidentiality and integrity of financial information.

Compliance with industry regulations is a factor that should not be overlooked. This involves meticulously overseeing the outsourcing partner's processes to guarantee adherence to legal standards and industry-specific requirements.

Long-Term Benefits of Outsourcing Accounting

The long-term benefits of outsourcing accounting goes beyond immediate cost savings. Businesses in 2024 are increasingly recognising the profound impact on overall efficiency. By entrusting routine tasks to specialised professionals, internal teams can redirect their focus to strategic initiatives, creating a more agile and innovative organisational culture. Moreover, outsourcing proves invaluable in adapting to ever-changing business dynamics. External experts, equipped with the latest industry knowledge, ensure that accounting functions remain adaptable to emerging trends and regulations.By leveraging external expertise and cutting-edge technology, businesses not only meet current demands but also position themselves to thrive in the face of future challenges, creating a resilient foundation for sustained success. Below are some of the findings from a recent case study on the benefits of outsourcing accounting tasks:

Source: Deloitte